By Christopher Cotton

Jarislowsky-Deutsch Chair in Economic & Financial Policy, Queen’s University

Director of the John Deutsch Institute for the Study of Economic Policy

Last week, I had the pleasure of presenting on the future of the Canadian economy during the 38th Annual Forecast Lunch hosted by the Smith School of Business and the Kingston Economic Development Corporation. This article is Part 2 in a 2-part series summarizing my presentation. Part 1 of this series shows that Canada is facing declining incomes stemming from structural issues beyond current trade woes.

Providing an economic forecast for the next year is an impossible task. At least, it is impossible to do with any degree of legitimate confidence. While some forecasters may get lucky with their guesstimates and claim their accuracy is an indication of brilliance, the reality is that no one knows for sure what the next year holds. The margin of error for 2026 is wider than it has been in decades.

The outlook for 2026 is clouded by three distinct sources of deep structural uncertainty:

- The Trump Trade Factor: The most substantial point of uncertainty facing the Canadian economy is the future of North American trade and US-Canadian relations. For three decades, Canadian businesses in most sectors have operated on the assumption that they would have continued open access to the U.S. market. That is no longer assured. Even as CUSMA (the current North American trade agreement) keeps the U.S. from increasing tariffs in most sectors, right now, the deal is up for renegotiation (or to be tossed out) next year. Next year, things may look very different.

In addition to the CUSMA uncertainty, there is also uncertainty about whether the U.S. Supreme Court will allow the President to use emergency powers to impose broad tariffs. But, even if the Supreme Court stops the tariffs, the President still has the power to walk away from CUSMA entirely or demand a complete rewrite. Whether it is a tariff fight in court or a trade deal fight at the negotiating table, the outcome is the same: businesses and investors do not know the rules of the game. Until they do, they are likely to pause major projects.

- Domestic Policy Uncertainty: In Part 1 of this article series, I discuss how political shifts, high costs, taxes, and red tape have created a gap in investment and talent between Canada and the rest of the G7. While the federal government has announced efforts to address some of these issues, investors are skeptical. The question is whether these new announcements will actually lead to real change, or if they will get bogged down by local politics and conflicting priorities between federal and provincial governments. Furthermore, investors worry that Canada’s tax system is focused more on spreading wealth than creating it, and without a clear, long-term commitment to growth that survives election cycles, private money may stay on the sidelines.

- Fiscal-Monetary Tension: Finally, there is a conflict at the heart of government economic policy. The federal government is pouring billions into infrastructure and housing to boost the economy and, hopefully, spur private investment. But there is a risk that this spending will backfire. Canada is already running low on skilled construction workers and materials. When the government targets spending to sectors that are already strained, without addressing other constraints, it may push up prices and the cost of living with little real impact on the economy. Such inflation causes the Bank of Canada to keep interest rates high, potentially further crowding out private-sector investment.

Given these variables, predicting a single path for the economy is impossible. Instead, it is more rigorous to consider the array of possibilities. Drawing on scenarios currently debated by financial institutions and forecasters, here are the Five Economic Archetypes for the year ahead.

The Five Scenarios

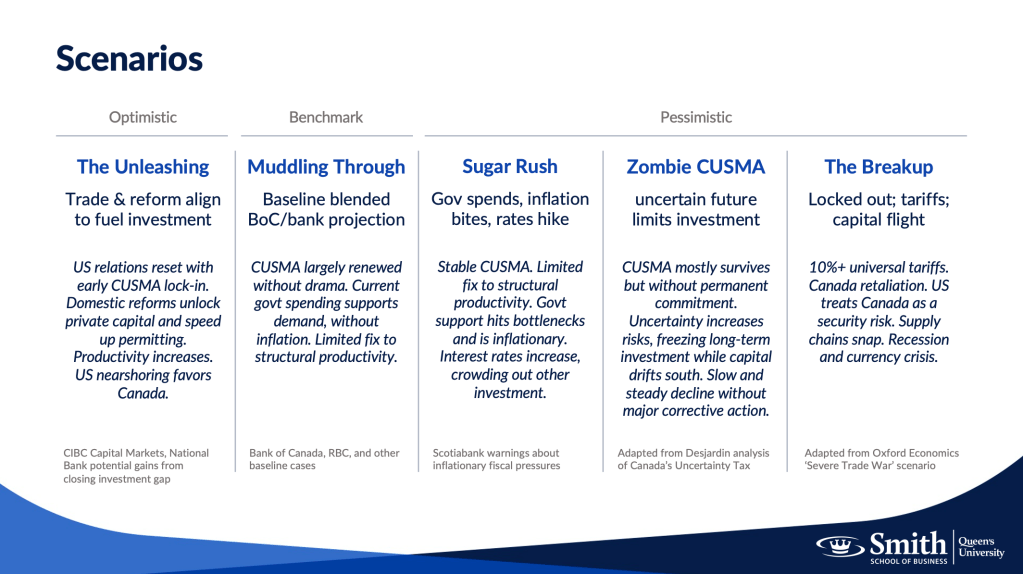

Given this uncertainty, I developed five scenarios describing how the Canadian economy could evolve over the next 12 months. These scenarios are not detailed predictions, but rather archetypes describing a range of outcomes that have been discussed as feasible. By considering feasible economic scenarios, organizations can plan for alternative contingencies.

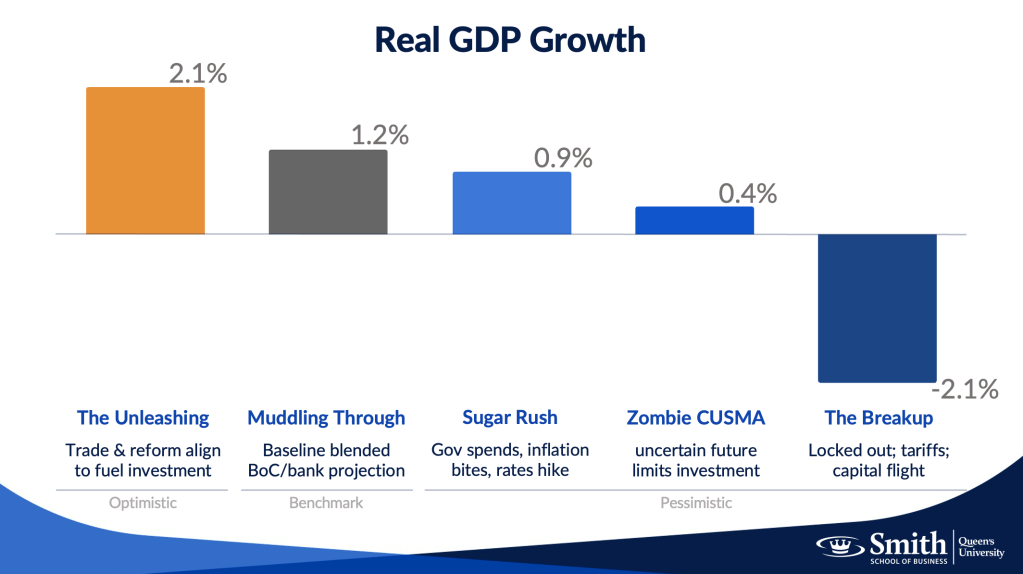

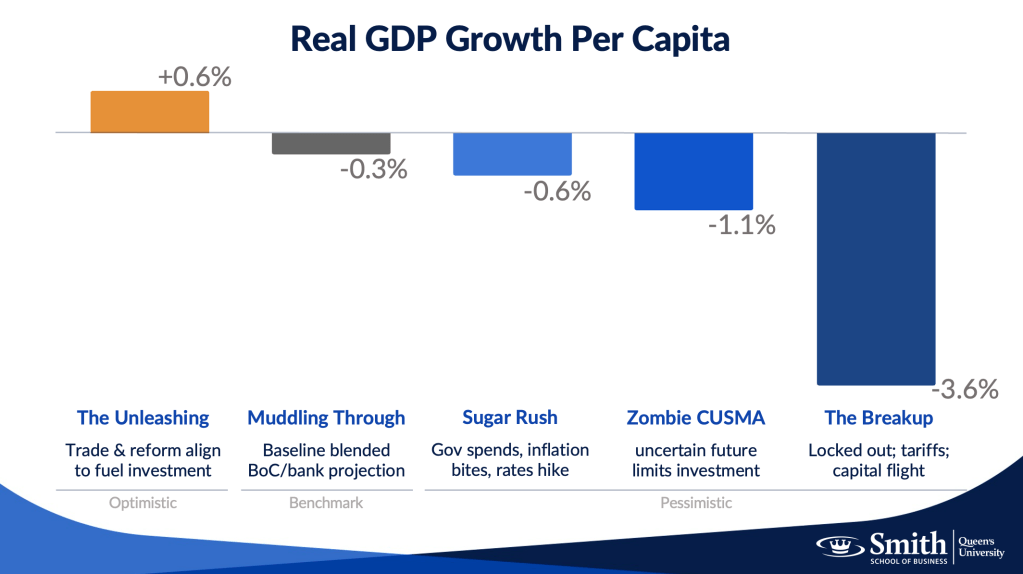

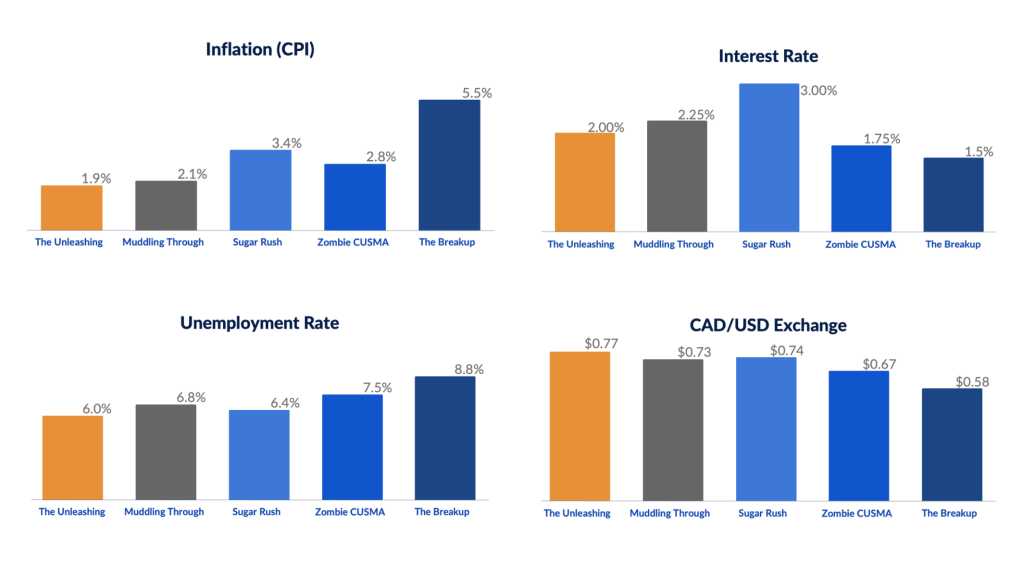

1. “The Unleashing of North American Trade”: This is the “best case” scenario. It assumes a stabilization of US-Canada relations, seamless CUSMA renewal, and successful domestic deregulation. Here, structural reforms and long-term commitments unlock private capital, accelerating Canada’s GDP growth. While aspirational, this remains the benchmark for what is possible if we get the policy mix right.

2. “Muddling Through” (the Baseline scenario): Aligning with the consensus projections of the Bank of Canada, RBC, and some other banks’ baseline cases, this scenario assumes the status quo mostly prevails. The economy absorbs fiscal supports efficiently, CUSMA’s renewed, with trade relations remain stable but unimproved, and overall growth continues at a modest pace (approx. 1.2%). Crucially, because economic growth lags population growth in this scenario, it implies a continued “muddling” decline in per capita wealth.

3. “The Sugar Rush” (fiscal inflation) This scenario captures the risk of inflationary overheating. Government spending on housing and infrastructure collides with labour shortages, resulting not in higher output, but higher prices. Inflation spikes above 3%, forcing the Bank of Canada to potentially increase interest rates, thereby crowding out private investment.

4. “Zombie CUSMA”: Perhaps the most insidious risk is a scenario where CUSMA survives technically but fails to provide certainty. It is undead — not quite dead, but not alive either. If the agreement enters a state of permanent “review” or political contention, businesses adopt a “wait and see” approach before investing in Canada. This uncertainty acts as a tax on capital expenditure, causing investment to freeze or drift toward the US.

5. “The Breakup”: This scenario contemplates a complete breakdown in trade relations between Canada and the U.S., and the imposition of universal tariffs as the U.S. has placed on other countries. This represents a stagflationary shock: a deep recession caused by a loss of market access, accompanied by a spike in the cost of living due to a sharp depreciation of the Canadian dollar. While “The Breakup” and “Zombie CUSMA” may arrive at similar outcomes in the longer term, “The Breakup” gets there more quickly.

Each of these scenarios paints a different potential picture of what the next 12 months might look like for the Canadian economy. By considering the range of outcomes, businesses, governments, and organizations can plan for different possibilities.

The actual outcome may combine various elements from these cases. For example, the economy may simultaneously experience inflationary pressures in some sectors, consistent with “Sugar Rush”, while experiencing further economic declines in the private sector due to partially unresolved trade uncertainty, consistent with a blend of “Zombie CUSMA” and “Muddling Through.” In such a hybrid scenario, government support increases, putting a floor under GDP, but it hits parts of the economy that are already near capacity, limiting its effectiveness. Simultaneously, trade uncertainty prevents the private sector from picking up the slack. The result is an economy that drifts forward but fails to gain real traction. While we may avoid a technical recession, the “drift” masks the cumulative damage of another year where private investment stagnates while our global competitors race ahead.

Where to from here?

The range of outcomes for 2026 is unusually wide. However, the common thread across all scenarios is that Canada cannot rely on external tailwinds or government spending to solve its economic challenges. To insulate ourselves against the shocks of a “Zombie CUSMA” and to “Unleash” the economy, we must address the structural issues that have led to a decline in Canadian investment, productivity, and income over the past decade.